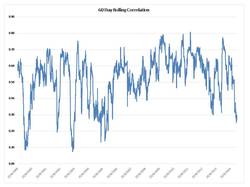

Are the VSTOXX® and VIX indexes becoming less correlated or is it simply natural for the correlation to have wider swings than the tight correlation range that occurred at the height of the financial crisis? This article examines this question by analyzing rolling correlations.

In my previous VSTOXX® articles I discussed the correlation of the VSTOXX® spot index to the VIX spot volatility index and highlighted the difference in correlations prior to the financial crisis versus during the crisis.

Recently, some volatility market participants have mentioned a possible breakdown in correlation between the two volatility indexes, thus it is an appropriate time to review their correlation. With the divergence in economic activity, U.S. equity market gains and the end of quantitative easing in the U.S. versus the EU’s sovereign debt issue, rate cutting and the declining euro, this begs the question: has the correlation of the volatility indexes recently shifted again?

READ MORE

Follow Mark Shore on Twitter, Facebook and Linkedin

Copyright ©2015 Mark Shore. Contact Mark Shore for permission for republication at info@shorecapmgmt.com Mark Shore has more than 25 years of experience in the futures markets and managed futures, publishes research, consults on alternative investments and conducts educational workshops.www.shorecapmgmt.com

Mark Shore is also an Adjunct Professor at DePaul University’s Kellstadt Graduate School of Business, where he teaches the only known accredited managed futures course in the country. He is also a Board Member of the Arditti Center for Risk Management at DePaul University.

Past performance is not necessarily indicative of future results. There is risk of loss when investing in futures and options. Futures and options can be a volatile and risky investment; only use appropriate risk capital; this investment is not for everyone. The opinions expressed are solely those of the author and are only for educational purposes. Please talk to your financial advisor before making any investment decisions.

RSS Feed

RSS Feed