By Mark Shore

www.shorecapmgmt.com

2014 had its share of commodity headlines. With the year now completed, this is a good opportunity to review the previous year of the commodity markets. There was something for everyone as some commodity markets rallied, but many commodity markets declined in 2014. Several of the markets experienced price lows not seen in several years.

The last several months of 2014 will definitely be known for falling oil prices as the topic found itself constantly in the headlines and in the conversation of the business, economic and political news. Besides energy, the metals and grain sectors made significant lows. One of the largest commodity moves in 2014 occurred in the rally of the coffee market. The meats sector made new highs last year.

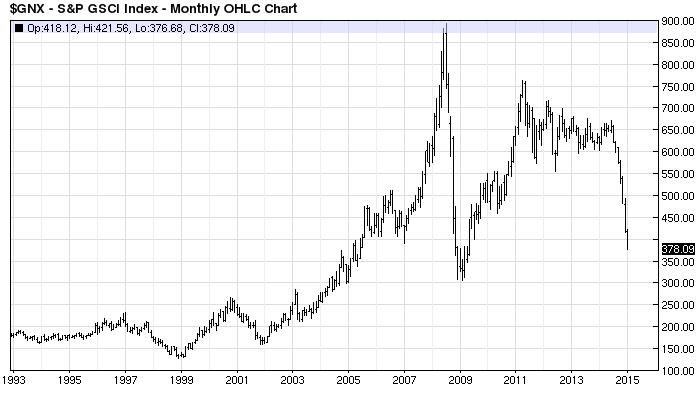

Chart 1: S&P GSCI Monthly Chart Jan 1993 to Dec 2014

As noted in the S&P GSCI index the overall move in the commodity index has gradually trended lower since 2011. In 2014 the S&P GSCI “fell off the cliff” as many commodities were reaching new lows as noted in Table 1 below.

It may not be intuitive to connect commodity prices to currency prices, but they do correlate. Many commodity prices are quoted in U.S. dollars. If the USD falls commodity prices may rise, as commodities appear cheaper outside the U.S. If the USD increases, commodity prices may fall as they become more expensive for other countries as they convert their local currency to USD. 2014 experienced a continuation of the USD index rally from bottom in May 2011. The USD index reached highs not seen since 2006. (Learn more about currencies click here).

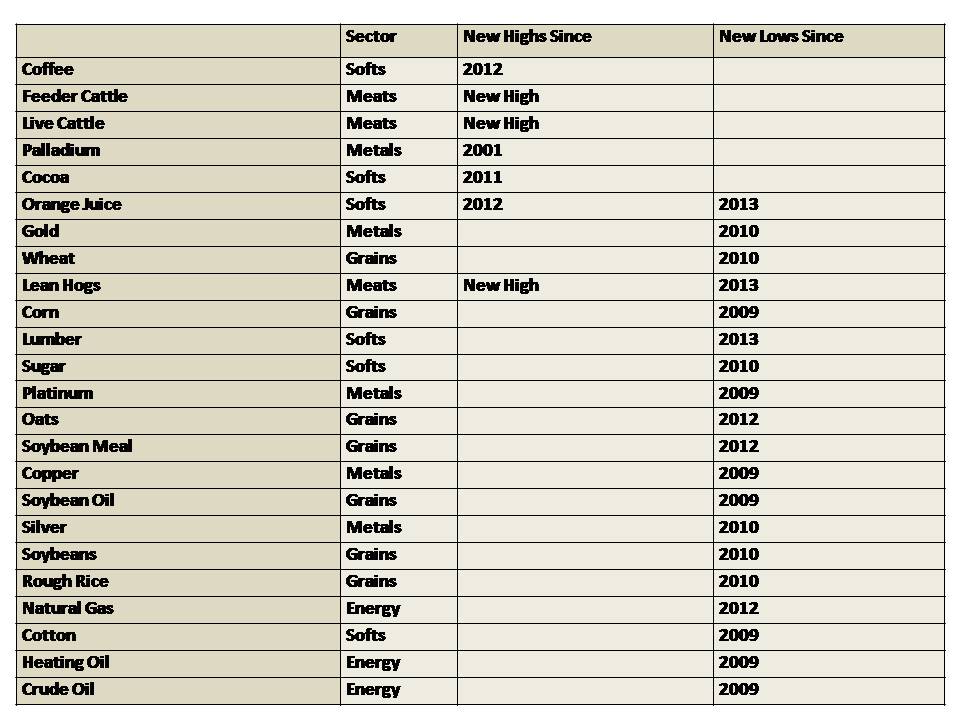

Table 1: Commodity Markets by Sector with Highs / Lows since previous years

Energy:

2014 experienced falling oil prices, falling heating oil prices and falling natural gas.

Movements in the commodities markets may have wide ranging consequences on various markets and entities around the world. For example, Russia was already under pressure from events with Ukraine earlier in the year. One could say the drop in crude oil was similar to throwing gasoline on a fire.

According to the EIA (U.S. Energy Information Administration), oil and gas equated to 52% of the Russian government’s revenue and more than 70% of Russia’s exports in 2012. They are the third largest producer of oil after Saudi Arabia and the U.S. and the second largest producer of natural gas after the U.S.[i] Russia’s loss of energy revenue helped to sustain the devaluation of the ruble. This in turn influenced the recently reported 11.37% Russian CPI rate of inflation[ii] and an increase of the Russian interest rates to 17% from 10.5% in December and then Russia cut rates to 15% on Jan 30th 2016.[iii]

Some OPEC countries are willing to accept a short-term decline in Oil prices, if it will damage the U.S. shale oil industry. June 2006 U.S. crude oil imports peaked at 10.8 million barrels per day on a four week average. The four week average as of December 26, 2014 was 7.5 million barrels per day equating to a 31% reduction of imports.[iv] The U.S. four week average of production bottomed at 3.9 million barrels per day in Oct 2005. As of December 26, 2014, the four week average crude oil production in the U.S. was 9.1 million barrels per day. This is an increase of 33% U.S. oil production since 2005.[v]

As the number one consumer of oil, the U.S. increased production and decreased imports in recent years, leaving a potential glut of the world oil supply. Plus the rallying dollar has made crude oil more expensive around the world. Falling oil prices are good for consumers of petroleum based products, but may hurt producers of the product. Can the reduction of oil prices be both good and bad for the U.S.?

Softs (Coffee, Cocoa, Cotton, Orange Juice, Sugar, Lumber):

Rallying markets included coffee, cocoa, orange juice. Declining markets include: Lumber, sugar and cotton. These markets originate from different parts of the world and may have various reasons for moving higher or lower.

Coffee: An important factor for coffee to rally in 2014 to highs not seen since 2012 was due to Brazil’s low amount of rain. Brazil is the largest producer of coffee and the largest producer of Arabica beans, thus the low rain factored heavily into coffee prices. (Click here for more information on coffee).

Cocoa: Demand for cocoa has outstripped the supply for the last few years. Increased weather concerns have also played into the greater uncertainty of the market. Many cocoa producing countries are the same countries with the highest ebola outbreak in 2014, thus causing production scares, uncertainty and increased pricing. Both production and consumption have increased, but production has increased and decreased over the past decade while consumption has been on a steady upward climb. According to the International Cocoa Organization (ICCO), the estimated ratio of stocks to consumption for the 2013/2014 year has decreased to 38.9, the second lowest since the 2004/2005 crop year.[vi]

Meats

Feeder cattle, live cattle and lean hogs all made new highs in 2014. The cost for a good steak was climbing in 2014. There were a few factors for the higher cattle prices in 2014. 1) U.S. cattle inventory reached new lows. According to the USDA, the inventory is the lowest since they began mid-year inventory reporting in 1973.[vii] 2) Yields of feed grain increased and prices fell, allowing cattle producers to hold onto cattle for a longer period of time. 3) As prices are increasing producers are increasing the weight of cattle.[viii]

Grains:

The entire grain sector moved lower in 2014 and reached the lowest prices from two to five years prior. The most interesting was the soybean market (click here to read more about soybeans). Since breaking above the resistance price of $10 per bushel in 2010, soybeans found continued support in the $10 to $12 price range and eventually surpassed $17 in Sept 2012. In the fall of 2014 the price of soybeans finally broke the support level of $10 and declined to just above $9.

2013 and 2014 were back to back years of large production for corn and soybeans assisted by a near perfect 2014 summer growing season causing a sustained price decline. In 2012 drought conditions during the growing season caused the rally in the grain markets.[ix]

Metals

2014 was not a glittering year for precious or industrial metals. Prices were falling to lows not seen since 2009 or 2010 (respective of the market viewed). Factors impacting the precious metals market included the continued rally of the U.S. dollar and a larger focus on the Fed unwinding QE and possible rate increases. Increased global economic slowdown and uncertainty as experienced in Europe impacted the base metals sector.

Dairy:

A market that many consumers use every day, but did not make the headlines was milk. Rising prices and falling prices (end of the year), high profit margins due to increased prices and low feed grain prices as mentioned above. However, U.S. consumption of fluid milk and cream has declined. In 1970 the U.S. consumption per capita was 273.8 pounds per year. In 2012 consumption fell to198.8 pounds.[x] Milk is a global market and the demand is growing quickly in China and other parts of Asia.[xi]

In 2014 Coca-Cola reported they are getting into the milk industry with a premium brand called Fairlife as a joint venture with the dairy co-op Select Milk Producers. [xii] According to the USDA, dairy prices were 5.3% higher in December 2014 relative to December 2013.[xiii] Class III milk used for various cheeses is traded at the CME Group.

As this article points out, various factors will influence specific commodity markets, but the results of that market may spill-over into other markets and parts of a domestic as well as the global economy. Time will tell if the various commodity markets will continue their current moves. (Learn more about commodity markets click here).

[i] http://www.eia.gov/countries/cab.cfm?fips=RS

[ii] http://www.global-rates.com/economic-indicators/inflation/consumer-prices/cpi/russia.aspx

[iii] http://www.bbc.com/news/business-31057283

[iv] http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=wcrimus2&f=4

[v] http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=wcrfpus2&f=4

[vi] http://www.icco.org/about-us/international-cocoa-agreements/cat_view/30-related-documents/47-statistics-supply-demand.html

[vii] http://igrow.org/livestock/profit-tips/cattle-inventory-declines/

[viii] http://www.ers.usda.gov/data-products/food-price-outlook/summary-findings.aspx

[ix] http://www.wsj.com/articles/grain-soybean-futures-fall-as-usda-ramps-up-crop-projections-1410454858

[x] http://www.ers.usda.gov/amber-waves/2014-june/trends-in-us-per-capita-consumption-of-dairy-products,-1970-2012.aspx#.VM7GO9LF-So

[xi] http://money.cnn.com/2014/06/09/investing/milk-money/

[xii] http://www.bloomberg.com/bw/articles/2014-12-01/coca-cola-prepares-to-build-a-milk-brand-called-fairlife

[xiii] http://www.ers.usda.gov/data-products/food-price-outlook/summary-findings.aspx

Copyright ©2015 Mark Shore. Contact the author for permission for republication at [email protected] Mark Shore has more than 25 years of experience in the futures markets and managed futures, publishes research, consults on alternative investments and conducts educational workshops. His research is found at www.shorecapmgmt.com

Mr. Shore is also an Adjunct Professor at DePaul University's Kellstadt Graduate School of Business where he teaches a graduate level managed futures/ global macro course. He is a board member of DePaul University’s Arditti Center for Risk Management and a frequent speaker at alternative investment events. He is a contributing writer for the Eurex Exchange, CBOE Futures Exchange, Examiner.com and Micro-Cap Review.

Mr. Shore hosts the popular internet talk show on alternative investments “Skewing Your Diversification”.

Prior to founding Shore Capital, Mr. Shore was Head of Risk for Octane Research Inc ($1.1 billion AUM) in NYC, where he was responsible for quantitative risk management analysis and due diligence of Fund of Funds. He chaired the Risk Management Committee and was a voting member of the Investment Committee.

Prior to joining Octane, he was the Chief Operating Officer of VK Capital Inc, a wholly owned Commodity Trading Advisor unit ($250 million AUM) of Morgan Stanley. Mr. Shore provided research and risk management expertise on portfolio construction, product development and business strategy. Mr. Shore graduated from DePaul University with a degree in Finance. He received his MBA from the University of Chicago.

Past performance is not necessarily indicative of future results. There is risk of loss when investing in futures and options. Futures can be a volatile and risky investment; only use appropriate risk capital; this investment is not for everyone. The opinions expressed are solely those of the author and are only for educational purposes. Please talk to your financial advisor before making any investment decisions.

RSS Feed

RSS Feed