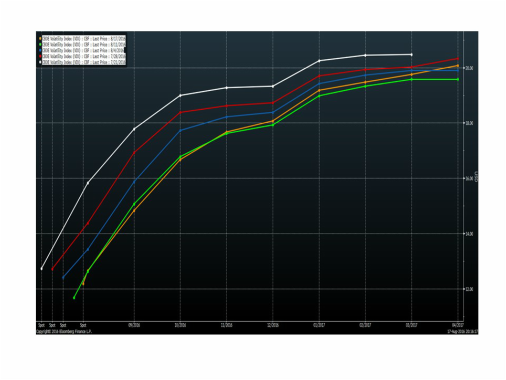

The webinar also dicusses the newly listed VSTOXX® Options on Futures, which are now available for US traders and investors since February 2017.

Follow Mark Shore on Twitter, Facebook and Linkedin

Mark Shore has more than 30 years of experience in the futures markets and managed futures, publishes research, consults on alternative investments and conducts educational workshops. www.shorecapmgmt.com

Mark Shore is also an Adjunct Professor at DePaul University’s Kellstadt Graduate School of Business, where he teaches the only known accredited managed futures course in the country. He is also a Board Member of the Arditti Center for Risk Management at DePaul University.

Past performance is not necessarily indicative of future results. The opinions expressed are only for educational purposes. Please talk to your financial advisor before making any investment decisions.

RSS Feed

RSS Feed