In our last article Spreading European and U.S. volatility index futures, we discussed various points of how investors and traders could utilize spread positions between VSTOXX® Futures contracts traded at Eurex Exchange and VIX futures as a volatility index spread strategy. We thought it was logical to next examine the forward curves or term structures of these two volatility derivatives for similarities and differences with the goal of revealing potential trading opportunities between the two.

This article will examine several issues to present a more complete picture for readers. First, we will look at how each term structure moves under different market conditions. Second, we will present possible trading opportunities related to the differences between the term structures. Third, we will suggest reasons for the contango markets observed in both products. And finally, we will raise additional questions that will be answered in subsequent research.

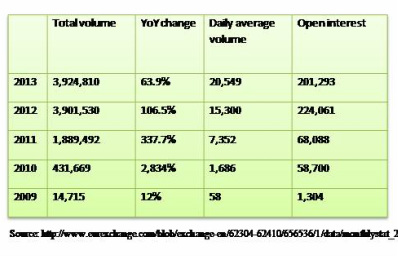

For investors and traders liquidity is always an important component for trading a market. The liquidity of VSTOXX® Futures continues to increase as noted in Table 1.

To examine the term structures of VSTOXX® Futures and VIX futures, we looked at the average term structure of the two products under the following conditions to determine if the term structure of each changes in different market environments.

READ MORE

Follow Mark Shore on Twitter, Facebook and Linkedin

Copyright ©2013 Mark Shore. Contact the author for permission for republication at [email protected] Mark Shore has more than 25 years of experience in the futures markets and managed futures, publishes research, consults on alternative investments and conducts educational workshops. www.shorecapmgmt.com

Mark Shore is also an Adjunct Professor at DePaul University's Kellstadt Graduate School of Business in Chicago where he teaches a managed futures/ global macro course. He is a Board Member of Arditti Center of Risk Management at DePaul University and an Adjunct at the New York Institute of Finance. Mark is a contributing writer to Eurex Exchange, Reuters HedgeWorld, CBOE Future Exchange (CFE) and Micro-Cap Review.

Past performance is not necessarily indicative of future results. There is risk of loss when investing in futures and options. Futures and options can be a volatile and risky investment; only use appropriate risk capital; this investment is not for everyone. The opinions expressed are solely those of the author and are only for educational purposes. Please talk to your financial advisor before making any investment decisions.

RSS Feed

RSS Feed