In today’s market environment, volatility is an increasingly important asset class. The benefits of volatility futures contracts are numerous:

-Volatility futures as a sector or asset class may increase a portfolio’s diversification or hedging opportunities.

-It tends to be negatively correlated to stock indexes.

-With contracts like VSTOXX® Futures, which are EUR-denominated volatility futures, an investor with EUR-denominated equity exposure does not have currency risk and exposure. Further, with increased volatility in the Eurozone, VSTOXX® Futures are a targeted way to gain exposure to Europe.

VSTOXX® Futures are listed at Eurex Exchange and are derived from the underlying EURO STOXX 50® Index Options. The increasing demand by investors to reduce portfolio volatility caused the development of volatility futures. The VSTOXX® Future contract is a 30 day forward on the implied volatility of the EURO STOXX 50® Index.

VSTOXX® Futures feature the same benefits of any exchange traded futures contract: 1) Marked-to-Market transparency. 2) Offering liquidity for hedgers and investors (See table 2). 3) Regulated exchange and market. 4) Central clearing of transactions, reducing counter-party default risk. 5) Price discovery of the market. 6) Standardized trading hours and contract specifications. FVS is the VSTOXX® ticker symbol.

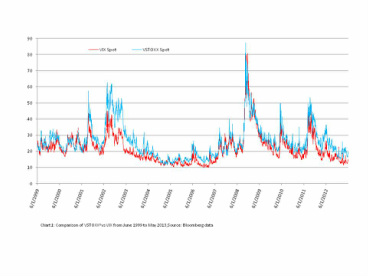

For U.S.-based traders and investors, it makes sense to compare the VSTOXX® and VIX® Indexes from a historical perspective.

To understand the VSTOXX® Index, let’s first define the EURO STOXX 50® Index. The index represents READ MORE

Follow Mark Shore on Twitter, Facebook and Linkedin

Copyright ©2013 Mark Shore. Contact the author for permission for republication at [email protected] Mark Shore has more than 25 years of experience in the futures markets and managed futures, publishes research, consults on alternative investments and conducts educational workshops. www.shorecapmgmt.com

Mark Shore is also an Adjunct Professor at DePaul University's Kellstadt Graduate School of Business in Chicago where he teaches a managed futures / global macro course and an Adjunct at the New York Institute of Finance. Mark is a contributing writer to Reuters HedgeWorld.

Past performance is not necessarily indicative of future results. There is risk of loss when investing in futures and options. Futures and options can be a volatile and risky investment; only use appropriate risk capital; this investment is not for everyone. The opinions expressed are solely those of the author and are only for educational purposes. Please talk to your financial advisor before making any investment decisions.

RSS Feed

RSS Feed